The Biggest Trends In Supply Chain in 2023, According To Top VCs

As we move post-pandemic, post CHIPS Act, post Inflation Reduction Act, our supply chain remains fragile yet central in the global commerce conversation. At the dawn of 2023, we sit atop a looming recession, war, an overflow of pent-up goods, and an outpouring of AI. What is in store for the global supply chain? And what are investors paying attention to?

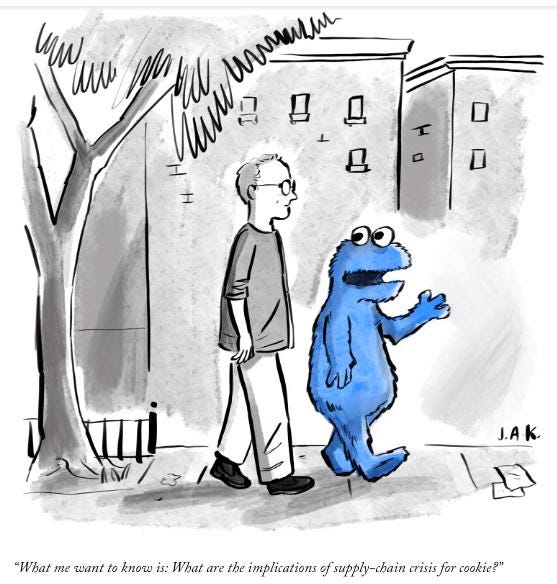

New York Cartoon, October 14

https://www.newyorker.com/cartoons/daily-cartoon/thursday-october-14th-cookie-supply-chain

Below, hear from top venture capitalists focused on investing in supply chain for their predictions on 2023:

“Over the last 2 years, there has been a major surplus of inventory due to supply chain disruptions, inventory management issues, and a slowing economy and changing consumer purchasing patterns. In 2023, I expect to see the rise of B2C shopping platforms that utilize this excess stock, or B2B platforms that enable offloading of surplus inventory.”

— Laura Chau, Canaan

“War, disease and politics will continue to drive reconfiguration/ reshoring/ automation in global supply chains. More high quality tech talent will become available for supply chain reconfiguration as Big Tech sheds data scientists, software engineers and automation engineers. Companies get serious about ESG/carbon accounting via industry associations that define standards for specific supply chains…

HOWEVER, end-to end visibility remains an illusion for most supply chains — there are still plenty of dark holes in the data. The migration crises continue, straining global relief supply chains and creating human suffering. And supply chain investments fall off the C-Suite top ten list as other priorities emerge in a recessionary environment.”

— Dave Anderson, Supply Chain Ventures

“We believe that for retailers and brands, optimizing supply chains will be the biggest focus of 2023. As the market resets with a focus on fundamentals, retailers will likely turn to post-delivery, returns, and disposition as a means to salvage margin, rather than the focus on top-line growth in unprofitable channels of the past few years. Given the continued prevalence of excess inventory and elevated return rates, an effective disposition strategy will be critical for retailers seeking to protect margins in 2023.”

— Chelsea Zhang, Equal Ventures

Consumer disdain for wastefulness (we are post COVID exuberance, dealing with inflation/recession and seeing our planet in distress) everywhere in commerce drives…

1) Too much inventory in the world — excess (sold once/never sold, used/never used) inventory will be much better qualified for re-sale/use and find new homes more efficiently at better cost through new platforms and marketplaces. “1st owner” status with many goods becomes a luxury.

2) The delivery promise shifts from fast (today/tomorrow) and free to trust (when will it arrive — date specific). Speed (next day) becomes a premium, paid, option for most non-consumable SKUs

3) Consumers will invest in Brands that put ESG gets put at the heart of who they are — core to consumer trust. ESG shifts from strategies to quantified/measurable impact consumers can actually understand and ‘hold in their hand’ — eventually the ‘cost to the planet’ for any SKU/service becomes an expected consumer disclosure like calories on a menu.”

— Maia Benson, Forum Ventures

“Two of the supply chain trends I’m tracking as we move into 2023 are:

Sustainability. In 2023 I think we will see a focus on more accurate carbon tracking for supply chains — using actual data from the production process, rather than estimates. We are also seeing rapid growth in the circular commerce sector, with brands focused on sustainable management of unsold inventory, returned merchandise and post-consumer recycling and resale. Resilience. Brands are still redesigning their supply chains to build more resilience after the challenges presented by COVID lockdowns. Specifically, brands will be focused on addressing resilience in second and third tier suppliers, not just direct suppliers, to reduce risk.”

— Anna Barber, M13

(Photo by Justin Sullivan/Getty Images)

Getty Images

It is interesting to note how similar many of the predictions are. Who will be wrong, and which contrarian will be right? One thing is for sure: more capital will be deployed into supply chain technology in 2023 on the heels of major macro social and geopolitical shifts that have made “supply chain” a household phrase in a way it was never before 2021. And, as crisis vintages make for some of the best private market returns, you can expect this to be an eye-popping space to watch.